Items in stock only

{{ filter.label }}

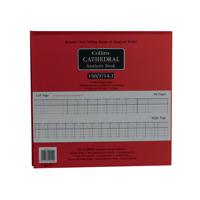

Accounts Books

From small business owners to professional accountants, we have everything you need to stay organised and manage finances effectively. Our range of finance pads includes account books for meticulous record-keeping, column analysis books for in-depth financial analysis, and petty cash vouchers for accurate tracking of expenses. A double ledger ensures precise bookkeeping, while analysis books help you analyse income and expenses effortlessly. Additionally, we offer wage books and pay slips to streamline payroll management. These are also available as duplicate books in case you need to keep copies for your financial records.

Trust us to provide you with the best tools for bookkeeping analysis that simplifies your accounting tasks. Stay on top of your financial game with our reliable and user-friendly products.

FAQs:

- What is petty cash? Petty cash is money kept on hand by a business for making small, day-to-day purchases. It’s used for minor expenses like office supplies, postage, or small incidental purchases. Petty cash is usually managed by a designated person within the business who is responsible for distributing the funds and keeping track of the expenditures with petty cash vouchers.

- How do you fill in a double-entry ledger book? To fill in a double-entry ledger book, use the two columns to record debit and credit. Identify the accounts involved and record the amount of money either received (debit) or given (credit). Ensure the debits and credits are balanced and record the date and a brief description of the transaction.

- What is a wage book? A wage book tracks and manages employee wages. It contains details such as employee names, hours worked, hourly rates, overtime, and deductions. The book helps employers calculate wages accurately, monitor attendance and payroll expenses, and ensure legal compliance. It also tracks employee benefits, such as vacation and sick days.